gfal loan table|GSIS Financial Assistance Loan (GFAL) : Bacolod Ang loan proceeds ng GFAL ay ibabayad ng GSIS sa DepEd accredited lending institutions, at ang tseke ay ire-release lang sa authorized . Bank of the Philippine Islands (BPI) is 166 years old this year. Its history of trust is closely intertwined with the Philippines’ narrative of progress and development

PH0 · What is GSIS Financial Assistance Loan to DepEd Personnel (GFAL)?

PH1 · What is GSIS Financial Assistance Loan to DepEd Personnel

PH2 · Procedures to Be Undertaken If the GFAL Applicant

PH3 · Multi

PH4 · GSIS: P221 billion in loans released from January 2021 to May 2022

PH5 · GSIS Financial Assistance Loan to DepEd Personnel (GFAL)

PH6 · GSIS Financial Assistance Loan to DepEd Personnel

PH7 · GSIS Financial Assistance Loan (GFAL) Program • DepEd

PH8 · GSIS Financial Assistance Loan (GFAL)

PH9 · GFAL – Education Loan – Government Service

PH10 · GFAL Sample Computation

PH11 · Frequently Asked QuestionsGSIS Financial

Ulaanbaatar (Улаанбаатар) — also Ulan Bator, UB, or in the local language, Khot ("the city") — is the capital and the largest city of Mongolia. With more than 1.6 million residents as of 2023, Ulaanbaatar is home to roughly half of Mongolia's population and serves as the starting point for pretty much all travel to Mongolia.

gfal loan table*******GFAL is the pension fund’s response to the call of President Duterte to save teachers and other government employees from the bondage of debt. Application is extended until .gfal loan tableThe maximum loanable amount is ₱100, 000.00 for each School Year or a maximum of ₱500, 000.00 for a five-year college degree. Qualified Student – Beneficiaries. Qualified borrowers may nominate up to two (2) student .GFAL Sample Computation | PDF | Amortization (Business) | Interest. GFAL sample computation.xlsx - Free download as Excel Spreadsheet .

Ang loan proceeds ng GFAL ay ibabayad ng GSIS sa DepEd accredited lending institutions, at ang tseke ay ire-release lang sa authorized .

GFAL is the “GSIS Financial Assistance Loan to DepEd Personnel” that allows eligible borrowers (DepEd teaching and non-teaching personnel) to refinance their outstanding .1. The GFAL to DepEd Personnel shall have redemption insurance (Rl) to safeguard the interests of both the member and the GSIS in case of the former’s untimely death during the term of the loan. 2. The RI rate is as .

Money. GSIS: P221 billion in loans released from January 2021 to May 2022. By TED CORDERO, GMA News. Published June 16, 2022 7:09pm. The .by Mark Anthony Llego. Below are the official instructions on the procedures to be undertaken if the GFAL applicant has Due and Demandable (DND) loans with the GSIS. Table of Contents. .The following table indicates the maximum loanable amount and loan term for non-permanent and permanent employees with term or tenure. Special members with MOA with GSIS may apply for an amount equivalent to 14 .

The GFAL to DepEd Personnel shall have redemption insurance (Rl) to safeguard the interests of both the member and the GSIS in case of the former’s untimely death during the term of the loan. 2. The RI rate is as .

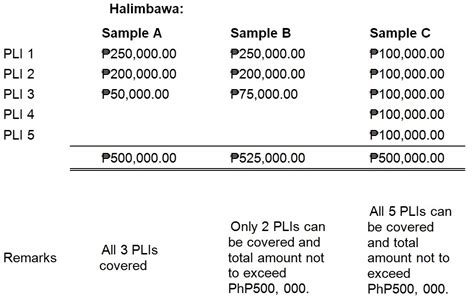

The GFAL will allow interested eligible borrowers (DepEd teaching and non-teaching personnel) to refinance their outstanding loans with private lending institutions (PLIs) accredited under DepEd’s Automatic Payroll .

Table of Contents GINHAWA FOR ALL (GFAL) ACTIVE 4 MEMBERSHIP COVERAGE AND CONTRIBUTION RATE 4 CLAIMS AND BENEFITS 6 A. Life Insurance Benefits 6 . B. GFAL-Education Loan 23 C. Policy Loan 24 D. Emergency Loan 25 OTHER PROGRAMS (Limited time offer) 26

GFAL is the “GSIS Financial Assistance Loan to DepEd Personnel” that allows eligible borrowers (DepEd teaching and non-teaching personnel) to refinance their outstanding loans with private lending institutions (PLIs) duly accredited under DepEd’s Automatic Payroll Deduction System (APDS). Supported by a budget of up to P50 billion, GFAL . Both teaching and non-teaching DepEd members can get a loan up to PHP 500,000 at an annual interest rate of 6% with a repayment period of 6 years. You can calculate the payment more accurately using GSIS GFAL loan calculator on the official website. The scheme is described in detail in the GFAL loan table.

Puwedeng mong isabay ang pag-aapply sa Top-Up Loan sa GFAL application mo. Kung nakapag-avail ka na ng GFAL, puwede ka pa ring mag-apply ng Top-Up Loan pero hindi dapat magsukobsa isang buwan ang availment ng dalawang loans. 10.Paano kino-compute ang Top-Up Loan?Areas eligible for Emergency Loan; Frequently Asked Questions (FAQs) Downloadable Forms; GW@PS; GCG Whistleblowing Portal; Audited Financial Reports MANILA – State pension fund Government Service Insurance System (GSIS) said it has posted disbursement of over PHP110 billion under the GSIS Financial Assistance Loan (GFAL) program since its launch in May 2018.. The program has benefited more than 271,000 government employees and will be extended until Dec. 29, .

Inilunsad ang Top-Up Loan upang upang matulungan ang mga members sa kanilang ibang pangangailangan habang binabayaran nila ang kanilang GFAL loan at hindi na sila umutang muli sa private lenders. 5. Sino ang pwedeng mag-avail ng Top-Up Loan? Ang mga sumusunod ang pwedeng mag-avail ng Top-Up Loan: a. GFAL availee; b.gfal loan table GSIS Financial Assistance Loan (GFAL) The Government Service Insurance System (GSIS) will open on April 23 the Multi-purpose Loan (MPL) Plus program that offers a credit limit of P5 million. It also extended the maximum payment term to 10 years and relaxed the borrowers’ eligibility requirements. “We enhanced the MPL program based on the feedback from members in .

GFAL is the “GSIS Financial Assistance Loan to DepEd Personnel” that allows eligible borrowers (DepEd teaching and non-teaching personnel) to refinance their outstanding loans with private lending institutions (PLIs) duly accredited under DepEd’s Automatic Payroll Deduction System (APDS). Supported by a budget of up to P50 billion, GFAL . Under the GFAL-Educational Loan (GFAL-EL), the maximum amount that may be borrowed per academic year is Php100,000 covering tuition and other school fees. The interest rate is only 8%. A GSIS member may nominate up to two student-beneficiaries under the program. The two must be related to him or her up to the third degree of . ako sa GFAL at emergency loan? Ang mga nakapag-avail na ng MPL ay pwedeng mag-renew sa ilalim ng MPL Plus hangga’t may net proceeds sa computation ng kanilang loan renewal. Ang bagong loan ay ibabase na sa terms and conditions ng MPL Plus. Halimbawa, ang dating payment term na 7 years ay magiging 10 years na. Kahit .GSIS Financial Assistance Loan (GFAL)The computer loan program or the CLP is the loan program that will allow public sector employees to borrow up to P30,000. This loan will be made payable up to three (3) years and will only have a six (6) percent interest rate annually; which is 0.5% per month. In case you wonder what this loan is for, the agency said that this is a loan program .Multi-purpose Loan and Consolidation of Debts or MPL will consolidate all the existing loans of a member, except housing loan. GSIS Multipurpose Loan (GSIS MPL) gives borrowers an additional credit line that will help them consolidate and pay their outstanding GSIS loan balances. Loanable Amount: Member may avail up to 14x of his basic .

In a Facebook post on Friday, Nov. 10, the pension fund for government workers shared that MPL Flex loans have surpassed P50.131 billion in disbursements since its launch in October. GSIS also reported that the loan program has received applications from a total of 183,478 members. The MPL Flex combines all the existing loans of a .Enhanced Conso-Loan Plus. Under the Enhanced Conso-Loan Plus Program, members who have at least 15 years of service with paid premiums may borrow a 12-month salary loan while those with not less than 25 years of service will be eligible for a 14-month loan. Previously, the credit limit for these members was only 10 times their salary.The principal balance of the GFAL-EL loan shall be computed as the total of: (a) The loan amounts covering the loan releases made by the GSIS during the study period, including capitalized interests; and (b) Interests for the 1-year allowance period of 12 months, if applicable. Loan Term. The total term of the loan is ten (10) years, divided into 2

Funds. Putnam Diversified Income Trust Class C +

gfal loan table|GSIS Financial Assistance Loan (GFAL)